Futa tax calculator

Web The business stops paying SUTA tax on Barrys wages once he makes 7000 which happens in the middle of Q2. Just like North Carolina has its unemployment tax so does the federal government.

Futa Tax Calculation Accuchex

Together with group health insurance a POP reduces taxable income and results in a reduction in the amount used to determine your companys FICA Federal Insurance Contributions Act and FUTA.

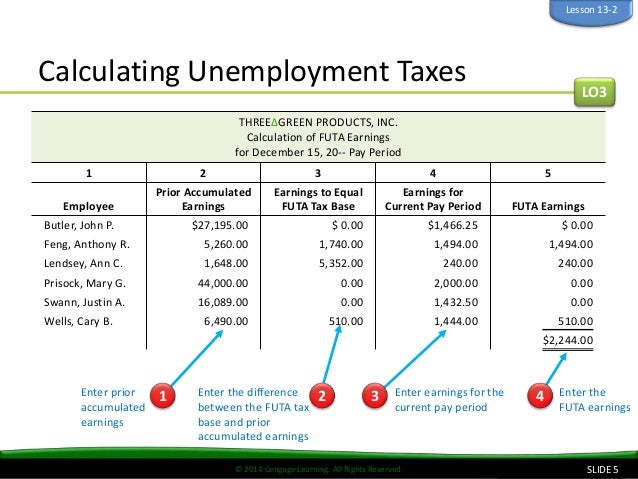

. Web For employers with very little payroll tax obligation less than 2500 a quarter deposits can be made quarterly with the 941 tax return. Web The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. The extended deadline for 2022 is.

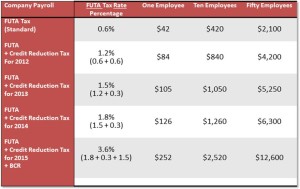

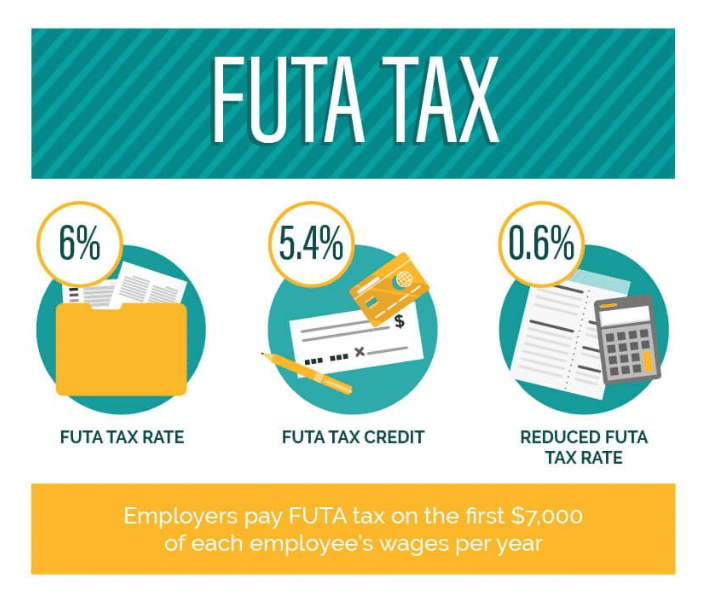

Calculate the FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income. If an employer has questions regarding the SUTA it would be wise to inquire with the proper agency. This tool allows.

How much you withhold here depends on the employees withholding selections on their Form W-4 The amount each employee withholds varies based on their earnings filing status and other factors. See the Employment Tax Due Dates page for information on when deposits are due. You also need to send employees their W-2 or 1099 forms at the end of the year plus file your businesss end-of-year taxes.

FUTA Unemployment TaxesYour employees sit this one out. Web Federal income tax. Tax credits directly reduce the amount of tax you owe dollar for dollar.

You can find all the information you need from the IRS Publication 15-T. Web Deduct and match any FICA taxes. Web Two common types of section 125 plans are.

The two taxes that only employees pay are. Web Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37. Web However they cant exclude this income from FICA tax and must pay the entire self-employment tax.

Premium Only Plan POP A POP allows you and your employees to pay insurance premiums with pre-tax dollars. Federal Employment Tax Due Dates If you determine your business needs to be on a monthly deposit schedule youll need to deposit your employment payroll taxes FICA and federal income taxes by the. This is a list of all state unemployment agencies.

Web The tax that only employers must pay is federal unemployment tax FUTA. Only employers are responsible for paying the FUTA tax. State income tax if required by your state Medicare tax.

Web Deposits for FUTA Tax Form 940 are required for the quarter within which the tax due exceeds 500. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06. If you cant meet this years deadline youll need to file an extension.

You must use electronic funds transfer to make all federal tax deposits. Its commonly called FUTA short for Federal Unemployment Tax Act. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

As Barrys employer you remit 150 of SUTA taxes at the end of March and 60 at. Web For the 2022 tax filing season individuals must file their tax returns by April 18. Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each.

We wont go into all the nitty-gritty details here. Web Both reduce your tax bill but in different ways. That means employees must pay their federal income tax liability throughout the year.

The tax must be deposited by the end of the month following the end of the quarter. Paycheck City is a free online withholding calculator. As an employer you deduct these taxes from your employees wages each pay period and remit them to the IRS quarterly.

Tax system is a pay-as-you-go arrangement.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Calculating Futa And Suta Youtube

Payroll Tax Rates 2022 Guide Forbes Advisor

Federal Unemployment Insurance Taxes California Employers Paying More Advocacy California Chamber Of Commerce

Futa Tax Overview How It Works How To Calculate

The Top How To Calculate Federal Unemployment Tax

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Formulate If Statement To Calculate Futa Wages Microsoft Community

Payroll Tax Calculator For Employers Gusto

The Futa Tax Rates For California Increase For 2016

What Is The Federal Unemployment Tax Rate In 2020

What Is Futa Tax It Business Mind

How To Calculate Unemployment Tax Futa Dummies

Futa Tax Who Must Pay How To File And Faqs

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks